courtesy of one wisconsin now

demonstrators against student loan debt

which recently topped 1 trillion dollars

a new york times article on u.s. student loan debt hits their most frequently emailed list.

student loan debt has outpaced all other forms of consumer debt, recently topping one trillion dollars.

Kelsey Griffith graduates on Sunday from Ohio Northern University. To start paying off her $120,000 in student debt, she is already working two restaurant jobs and will soon give up her apartment here to live with her parents. Her mother, who co-signed on the loans, is taking out a life insurance policy on her daughter.this takes places against a backdrop of greatly increasing enrollment at state colleges and universities, with funding there being radically cut, along with recent issues in Congress over letting interest rates double and further ravaging the (now minimal, once sorta robust) Pell Grant system.

“If anything ever happened, God forbid, that is my debt also,” said Ms. Griffith’s mother, Marlene Griffith.

Ms. Griffith, 23, wouldn’t seem a perfect financial fit for a college that costs nearly $50,000 a year. Her father, a paramedic, and mother, a preschool teacher, have modest incomes, and she has four sisters. But when she visited Ohio Northern, she was won over by faculty and admissions staff members who urge students to pursue their dreams rather than obsess on the sticker price.

“As an 18-year-old, it sounded like a good fit to me, and the school really sold it,” said Ms. Griffith, a marketing major. “I knew a private school would cost a lot of money. But when I graduate, I’m going to owe like $900 a month. No one told me that.”

rajeev v. date, deputy director of the Consumer Financial Protection Bureau - the federal watchdog created after the financial crisis - is likening excessive student loans to risky mortages with what the times describes as a "cast of contributing characters," including colleges and universities that encourage students and families into thinking that high amounts of debt are "doable and normal," and roots dating back to the 1980's when tuition began to rise faster than family income.

In the 1990s, for-profit colleges boomed by spending heavily on marketing and recruiting. Despite some ethical lapses and fraud, enrollment more than doubled in the last decade and Wall Street swooned over the stocks. Roughly 11 percent of college students now attend for-profit colleges, and they receive about a quarter of federal student loans and grants.

courtesy of RT

photographer: andrew burton/ap

students protest at union square, n.y.,

against rising student debt

Common Dreams reported in early April, and with sources from national newspapers like Washington Post and Time Magazine that $36 billion dollars in student loan debt belongs to Americans who are 60 years and older. It is not uncommon for social security checks to be taken and debt collectors to harass people for payments in their eighties.

The debt to this demographic comes as a result of unpaid loans from their original days in college, loans for mid-career education, and co-signing loans for younger family members, the research shows.

The plight of unpaid student loans has become a cause for increasing concern in recent years. Tuition continues to drastically outpace inflation, the job market for recent college graduates remains murky, and wages for are stagnant.

Another problem for borrowers is that as of 2005, when the Bankruptcy Abuse Prevention and Consumer Protection Act was passed, private student debt cannot be discharged in bankruptcy court. This lack of this consumer protection makes student debt nearly impossible to erase. “A student loan can be a debt that’s kind of like a ball and chain that you can drag to the grave,” said William E. Brewer, president of the National Association of Consumer Bankruptcy Attorneys, in an interview with the Washington Post. “You can unhook it when they lay you in the coffin.”

Sen. Dick Durbin (D-Illinois), has introduced legislation that would reinstate bankruptcy protection for students. Other groups, such as Occupy Student Debt, are fighting for a variety of protections for student borrowers.

courtesy of rt

photographer: khalid khan

occupy wall street march against student debt

signs read: "1,000,000,000,000" and "Occupy Wall Street"

From the NY Times article:

“I’ll be paying this forever,” said Chelsea Grove, 24, who dropped out of Bowling Green State University and owes $70,000 in student loans. She is working three jobs to pay her $510 monthly obligation and has no intention of going back.

“For me to finish it would mean borrowing more money,” she said. “It makes me puke to think about borrowing more money.”

Another former student, Wanda McGill, like many others, has stopped opening her bills. The Times reports:

She isn’t sure how much debt she has accumulated, though she thinks it’s about $100,000. But Ms. McGill, a 38-year-old single mother, knows for sure she cannot pay it.

Ms. McGill said she dropped out of DeVry University, a for-profit college with a branch in Columbus, two years ago after she ran out of money — even with the loans. She now makes $8.50 an hour working for an employment training center in Florida.

Similarly, and from an RT article, another student and single parent, Katie Zalman currently owes $111,000. She is a PhD candidate in sociology at the University of Wisconsin. Ms. Zalman states, “It's not going to be worth it. I might as well have not come to graduate school. I might as well be working at Starbucks right now." Her sentiments are echoed in the article by other students facing and anticipating a bleak employment market.

The Nation proposes:

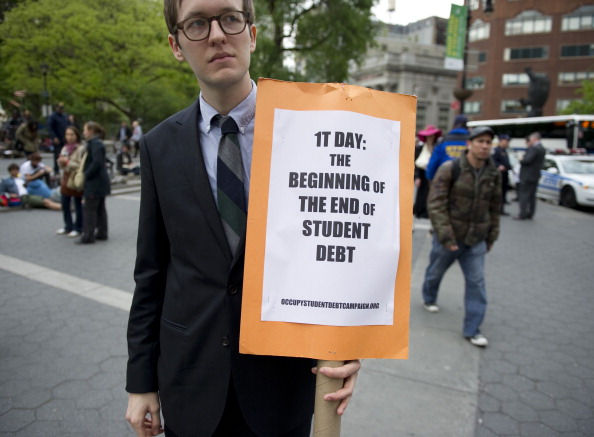

courtesy of in these times

photographer: don emmert

protester in new york on 4/25/12 or 1T Day

It is long past time for reform. Representative Hansen Clarke introduced a bill that would forgive up to $45,520 in student debt after a borrower makes ten years of payments at 10 percent of income. The Occupy Student Debt Campaign is calling for a write-off of existing debt as well as free public higher education. Students in California are pushing an initiative that would make four years of state university free for all full-time, in-state students who maintain at least a 2.7 GPA or do seventy hours of community service a year. Lost tuition would be paid for with a modest surtax on those earning more than $250,000.

Making public college (or advanced training) free for those who merit it isn’t a radical idea. For many years the United States led the world in free K–12 education. The GI Bill paid for college or advanced training for a generation of vets after World War II, which gave us the best-educated citizenry in the world and broadened the middle class. As recently as 1980, Pell grants covered 69 percent of public college costs; now they cover less than 35 percent.

We can easily afford the estimated $30 billion annual cost of free college education; a financial-transactions tax would raise many times that sum, and it would inhibit destabilizing speculation on Wall Street. We would reap the benefits of a better-educated citizenry, and young people could be more entrepreneurial and more public-spirited.

from RT below, a youtube below describes a growing movement to sue schools for refunds, accusing the schools of fraud and falsely inflating employment figures:

and looking at a new occupy, that is, occupy graduation, whereby graduating students plan to use their college or university graduation ceremonies to highlight the student debt problem, and by putting stickers on their caps with the dollar amount they owe, and wearing symbolic balls and chains.

more here at occupy graduation.

occupy student debt.

more blogging on student loan debt here and here.

No comments:

Post a Comment